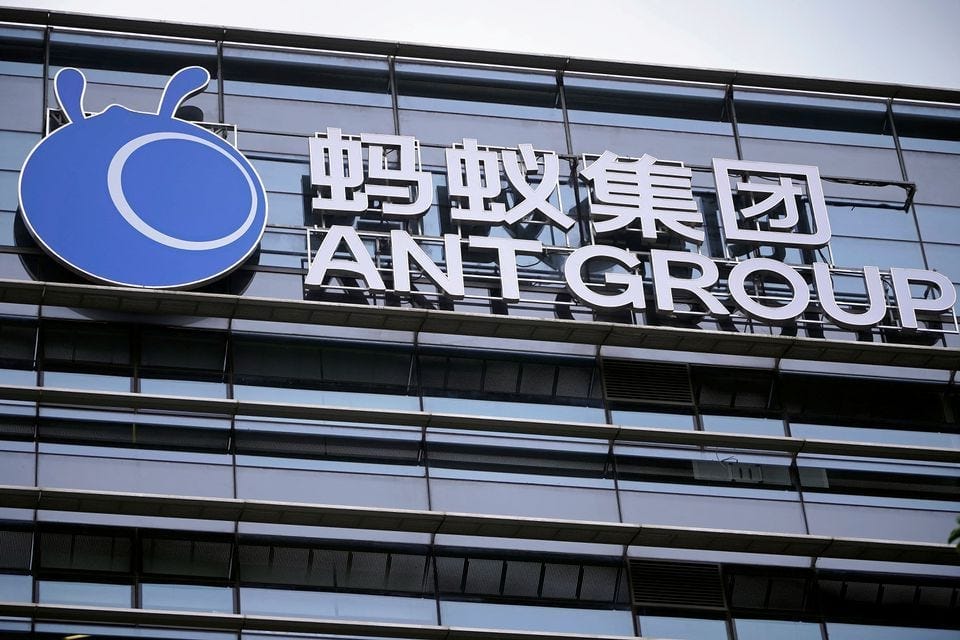

Ant Group's IPO Slumps Amid Government Scrutiny

Ant Group was earmarked to have the largest initial public offering ever for any company on the face of the earth. The IPO was set to happen this week.

Ant Group is more than a unicorn company. It is a behemoth in China’s financial tech industry that has over one billion monthly active users. It is a financial services and tech (fintech) company that facilitates payments within and outside of the Alibaba ecosystem.

Ant Group's Evolution

It was previously a middleman in online service payments before consumer trust in online transactions grew. Customers would pay Ant Group for a service or product, and after delivery, Ant would then pay the suppliers. With time, the company grew out of Alibaba into its own company. It now handles trillions of dollars of online payments every year. The company is still an affiliate of Alibaba and owns Alipay, China’s largest online payment services company.

Ant Group IPO: The Largest IPO Ever that Never Happened

Ant Group was earmarked to have the largest initial public offering ever for any company on the face of the earth. The IPO was set to happen this week. Ant’s IPO was set to raise a stipulated $37 billion, a figure that surmounted Saudi Aramco and Alibaba’s listings. The IPO was set to be a dual listing in the Shanghai and Hong Kong stock markets and had already raised more than three trillion dollars in retail bids.

Retail bids are bids made by ordinary people like you and me. The IPO was, however, halted by regulators in China citing major regulatory issues. The IPO was stopped at the eleventh hour, much to the markets’ anguish and interested buyers. Retail bids were especially a boost factor for the IPO and had seen numerous ordinary citizens borrow from banks and earmark their savings for investment in the company.

Ant Group a Broth of Service Offerings

Ant Group is such a huge deal because it is a broth of service offerings. It is a tech company, a financial services company, a lender, a savings company like a bank, and an insurance company. Regulators cited the lack of clarity for halting the company’s IPO as it only represented itself as a tech company or a fintech. Officials in Beijing had concerns about the licensure of the company as a financial entity. Regulators were of the school of thought that if Ant continues to offer such numerous services, it can only be listed in the markets after licensure as a financial services company, and possibly an insurance company or a bank.

Is Jack Ma Becoming Too Popular?

Some analysts say the halting of the IPO also has something to do with the man behind the company, Jack Ma, and his almost cult personality in China. Jack Ma is seen as the man to look up to and as an inspiration for many young people in China and worldwide. Analysts fear that the Ant Group IPO could have been stopped due to Jack Ma’s influence and his being seen as more admired and looked up to than Chinese President Xi Jinping.

Tech Companies Evolution from Just Being Tech Companies to also Being Financial Services Providers

From a financial and business perspective, technological companies are continually going over the boundary between being a tech company and a financial services provider. The same can be seen here in Kenya with Safaricom. Safaricom is a lender, an internet service provider (ISP), a telecommunications company, and a savings company. It acts as a bank, a telecommunications provider, and a bank at the same time.

The Blurry Lines of Fintech Companies

Having such blurry operational lines means that regulating such a company and reducing its potential for being a monopoly is increasingly hard. Safaricom is increasingly a monopoly, and since it is 25% owned by the government, it has been let to freely operate as is. It has also been unduly favored as some of its competitors Airtel and Telkom Kenya, were barred from merging. Analysts see this as a way for Safaricom to keep dominating and monopolizing the Kenyan market. Monopolization is further exacerbated by reducing competition and competitiveness and undue government interference.

Ant Group Bared From Initial Public Offering Due to Concerns About the Effects of the IPO on China's Financial Markets

Ant Group was also barred from undertaking its IPO due to concerns that such a huge listing would have unforeseen consequences for China’s financial market. When such a company that lacks full and transparent licensure is allowed to dominate the markets, many investors may invest their money in a behemoth that lacks real business value.

For instance, by investing in Ant as a technological company and not a bank or a financial services provider, different laws apply to the company as a tech company compared to the legislation that would apply to a financial services provider. The consequence is that Ant, in any event, would evade taxes and other legal requirements required for financial services providers and, in this way, be a risk to the stability of the markets. If it had listed and then faced legal and regulatory issues, many people, including ordinary people, would have likely lost their savings and investments.

Would a Huge Financial Market Listing such as Ant IPO Give Alibaba and Jack Ma Too Much Power?

There is also the notion that such a huge financial market listing would give too much power to Alibaba and Ant Group and the private sector. A communist government leads China, and communism is very much against capitalism. Communism encourages government ownership of a country’s assets and not the private sector’s ownership of such assets.

Even as such concerns may hold water, I think Ant Group should first get its business architecture and representation right. If it wants to be a tech company, let it outsource financial service offerings elsewhere or create a financial services branch. It could also apply for the licenses needed and hopefully become a licensed company across numerous sectors. The IPO is likely to go on in the future, even as it may take some time for the company to get its act together.